Midcoast CA$H

An Initiative of United Way of Mid Coast Maine

|

DOWNLOAD the flyer

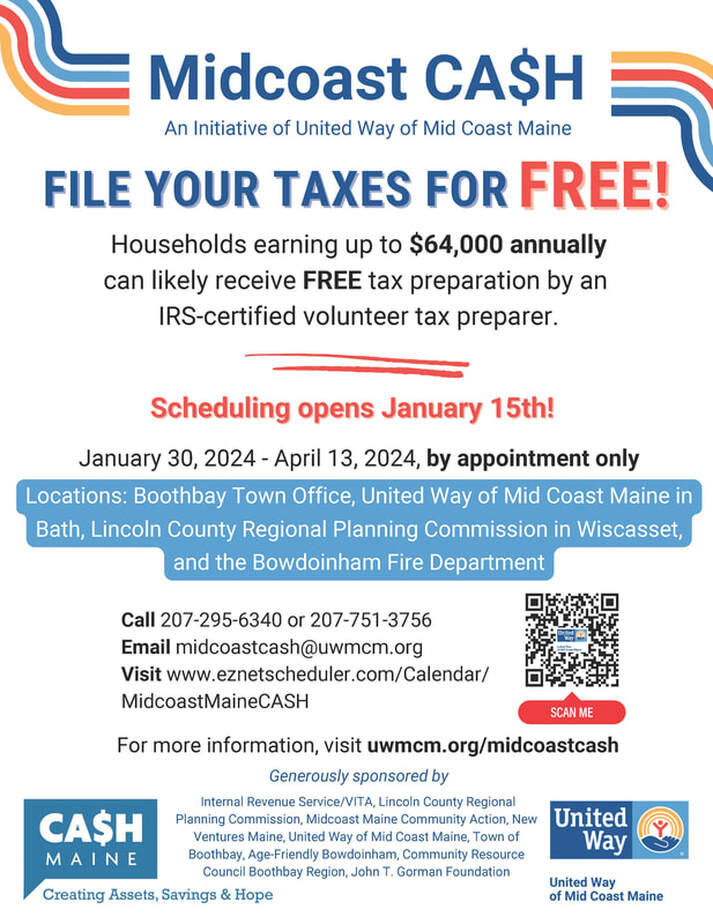

Locations: United Way of Mid Coast Maine 34 Wing Farm Parkway, Suite 201 Bath, Maine 04530 Lincoln County Regional Planning Commission 297 Bath Road Wiscasset, Maine 04578 Boothbay Town Office 1011 Wiscasset Road Boothbay, ME 04537 Bowdoinham Fire Department 57 Post Road Bowdoinham, ME 04008 |

2024 Schedule (*by appointment only):

January 30 – April 13, 2024 Tuesdays and Saturdays, 9:00 a.m. – 2:00 p.m. Thursdays, 3:00 p.m. – 8:00 p.m. *Appointment scheduling by phone begins January 15, 2024 To Schedule an Appointment (all locations): Call: 207-295-6340 or 207-751-3756; Email: [email protected]; Visit: www.eznetscheduler.com/Calendar/MidcoastMaineCASH |

Midcoast CA$H, an IRS Volunteer Income Tax Assistance (VITA) program, provides free tax preparation by IRS-certified volunteer tax preparers to households earning up to $64,000 annually. Our volunteer tax preparers make sure clients receive all federal and Maine tax credits that they qualify for, such as the Earned Income Tax Credit (EITC) and the Childcare Tax Credit (CTC). When requested, Midcoast CA$H also offers clients information about local programs that can help people save money and increase their financial stability, including debt-reduction programs, credit reviews, and match savings accounts.

Midcoast CA$H volunteers returned $766,834 to tax filers across the Mid Coast last year (2022 tax season). Click here to read more about our impact.

Midcoast CA$H volunteers returned $766,834 to tax filers across the Mid Coast last year (2022 tax season). Click here to read more about our impact.

Questions? Contact us to learn more.

General Inquiries: 207-295-6340

To learn more about volunteering and training, contact Steve Cohen at 207-751-3756

To learn more about Midcoast CA$H, contact Doreen Fournier, Director of Community Impact, at [email protected]

To learn more about volunteering and training, contact Steve Cohen at 207-751-3756

To learn more about Midcoast CA$H, contact Doreen Fournier, Director of Community Impact, at [email protected]